Comparing Fees: Stock Trading Platforms vs. Cryptocurrency Exchanges

In the dynamic world of online trading, investors traverse two distinct terrains: stock trading platforms and cryptocurrency exchanges. These platforms offer unique fee structures, shaping the trading experience for users. This detailed analysis aims to unravel the fee dynamics of these platforms, providing insights into their differences and offering key considerations for traders.

Stock Trading Platforms: Revolutionizing Traditional Trading

Fee Structures:

Traditional stock trading platforms have undergone a transformative shift, departing from per-trade commissions to embrace alternative fee models. While many no longer charge for individual trades, various fees have emerged, including account fees, inactivity fees, withdrawal fees. Some platforms even entice users with zero-commission trading, particularly for stocks ETFs.

Premium Features and Margin Trading:

Distinguishing themselves in a competitive landscape, certain stock trading platforms introduce fees for premium features, such as access to in-depth research tools. Additionally, the realm of margin trading carries its own costs, with interest levied on borrowed funds. These platforms differentiate by not only providing robust trading platforms but also offering quality customer support.

| Broker | Us stock | UK stock |

| Interactive Brokers | $1.0 | $3.7 |

| Alpaca Trading | $0.0 | – |

| Admirals (Admiral Markets) | $0.0 | $0.0 |

| IG | $15.0 | $9.9 |

| XM | $1.0 | $9.0 |

| MEXEM | $2.5 | $3.1 |

Stock trading platforms have indeed revolutionized traditional trading in several ways, leveraging technology to make financial markets more accessible, efficient, and user-friendly. Here are some key ways in which these platforms have brought about significant changes:

Accessibility and Convenience:

Global Reach:

Online trading platforms have made it possible for investors to access global markets easily. Traders can buy and sell stocks, commodities, and other financial instruments from anywhere in the world with an internet connection.

24/7 Trading:

Unlike traditional stock exchanges with fixed trading hours, many online platforms allow 24/7 trading, providing flexibility to investors in different time zones.

User-Friendly Interfaces:

Intuitive Design:

Trading platforms are designed with user-friendly interfaces, making it easier for both beginners and experienced traders to navigate and execute trades.

Mobile Accessibility:

The availability of mobile apps has further increased accessibility, allowing users to trade on the go using smartphones or tablets.

Reduced Costs:

Low Fees:

Online trading platforms often have lower transaction costs compared to traditional brokerage services, making it more cost-effective for retail investors.

Commission-Free Trading:

Many platforms have introduced commission-free trading, dropping the need for investors to pay fees for buying or selling stocks.

Democratization of Investing:

Fractional Shares:

Some platforms allow users to buy fractional shares, enabling investors with limited funds to access a diverse portfolio.

Social Trading:

Social features enable users to share insights, strategies, and trades, fostering a sense of community and allowing less experienced investors to learn from more seasoned traders.

Security and Regulation:

Secure Transactions:

Advanced encryption technologies and secure authentication methods ensure the safety of financial transactions and personal information.

Regulatory Compliance:

Reputable trading platforms adhere to financial regulations, providing users with a level of assurance about the legitimacy of the platform.

Market Innovation:

Cryptocurrency Trading:

Some platforms have expanded their offerings to include cryptocurrencies, allowing users to trade digital assets alongside traditional financial instruments.

Derivatives Trading:

Advanced trading platforms offer a range of financial derivatives, such as options and futures, supplying sophisticated tools for risk management and speculation.

Cryptocurrency Exchanges: Pioneering the Digital Frontier

Fee Structures:

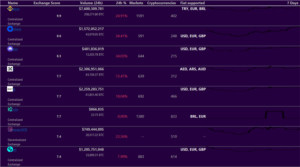

In contrast to stock trading platforms, cryptocurrency exchanges keep trading fees as a primary revenue source. These fees are often a percentage of the trade’s value. The maker-taker fee scheme is prevalent, where makers (market creators) typically incur lower fees than takers (market consumers). Fee percentages show significant variability across exchanges, ranging from 0.1% to over 1%.

Tiered Fee Systems:

Cryptocurrency exchanges often employ tiered fee structures based on trading volume. As trading volumes escalate, fees tend to decrease, incentivizing higher-frequency traders. This tiered approach deviates from the more standardized fee structures seen in traditional stock trading platforms.

Cryptocurrency exchanges play a pivotal role in the digital economy, serving as platforms where users can buy, sell, and trade various cryptocurrencies. These exchanges have been instrumental in pioneering the digital frontier by introducing new concepts, technologies, and financial instruments. Here are some ways in which cryptocurrency exchanges have contributed to this digital revolution:

Market Accessibility:

Global Reach:

Cryptocurrency exchanges run on a global scale, allowing users from different countries to participate in the digital economy without the need for traditional banking infrastructure.

24/7 Trading:

Cryptocurrency markets run 24/7, providing continuous trading opportunities compared to traditional financial markets with fixed operating hours.

Innovation in Financial Instruments:

Tokenization:

Cryptocurrency exchanges have facilitated the creation and trading of tokenized assets, standing for real-world assets like real estate or commodities on blockchain platforms.

Derivatives Trading:

Some exchanges offer derivatives such as futures and options, allowing users to hedge risks, speculate on price movements, and engage in more sophisticated trading strategies.

Decentralization and Peer-to-Peer Trading:

Decentralized Exchanges (DEX):

DEXs operate without a central authority, allowing users to trade directly with one another through smart contracts. This reduces the reliance on intermediaries and enhances privacy.

Peer-to-Peer Trading:

Some exchanges facilitate peer-to-peer trading, enabling users to buy and sell cryptocurrencies directly with each other without an intermediary.

Security and Custodianship:

Cold Storage:

Cryptocurrency exchanges employ advanced security measures, including cold storage solutions (offline wallets), multi-signature wallets, and encryption, to protect users’ funds from hacking attempts.

Custodial Services:

Some exchanges offer custodial services, providing an added layer of security by safeguarding users’ private keys and assets.

Token Listings and Initial Coin Offerings (ICOs):

Token Listings:

Exchanges play a crucial role in listing new cryptocurrencies, making them available for trading. This process can contribute to a cryptocurrency’s liquidity and overall market acceptance.

ICOs:

Exchanges have been instrumental in the fundraising process for blockchain projects through Initial Coin Offerings (ICOs), allowing companies to raise capital by issuing new tokens.

Regulatory Compliance:

Compliance Measures:

Reputable cryptocurrency exchanges implement Know Your Customer (KYC) and Anti-Money Laundering (AML) measures to comply with regulatory requirements, fostering a more secure and regulated environment.

A Quick Review of Stock Trading Platforms and Cryptocurrency Exchanges Fees

Commission Fees:

Stock Trading Platforms:

Most have phased out per-trade commissions, opting for alternative fee models.

Cryptocurrency Exchanges:

The majority still relies on trading fees, calculated as a percentage of transaction value.

Maker-Taker Fees:

Cryptocurrency Exchanges:

Utilize a tiered maker-taker fee system, offering lower fees for market creators.

Stock Trading Platforms:

Generally, do not implement a tiered system for transaction fees.

Trading Volume:

Cryptocurrency Exchanges:

Employ tiered fee systems based on trading volume, encouraging higher volumes with reduced fees.

Stock Trading Platforms:

Fees are often less influenced by trading volume, and the tiered approach is less common.

Fee Variability:

Cryptocurrency Exchanges:

Witness significant variability in trading fees across different platforms.

Stock Trading Platforms:

Tend to have more standardized fee structures, with fewer variations.

Conclusion:

In the expansive spectrum of financial markets, comprehending the fee structures of stock trading platforms and cryptocurrency exchanges is crucial for traders seeking profitable outcomes. While traditional stock platforms gravitate towards fee flexibility and zero-commission models, cryptocurrency exchanges persist in relying on trading fees, often introducing tiered systems.

Traders must discern the nuanced disparities in these fee structures, aligning their choices with individual trading strategies and preferences. Every penny saved in fees contributes to potential profits, underscoring the importance of informed decision-making in the realm of online trading. Whether navigating the familiar terrain of stock trading or venturing into the digital frontier of cryptocurrencies, a thorough understanding of fees empowers traders to optimize their trading experience and financial outcomes.