Understand the competitive landscape of transaction fees across stock trading platforms and cryptocurrency exchanges to optimize your investment journey.

The world of finance is undergoing a dramatic transformation, with online platforms facilitating both traditional stock trading and the growing realm of cryptocurrencies. In 2022 alone, the global online trading market reached a staggering $58 billion, and the cryptocurrency exchange industry is projected to reach $5 trillion by 2027. With such rapid growth comes a crucial question for both seasoned investors and curious newcomers: what are the fees involved, and how do they compare across different platforms?

Fees are the lifeblood of these platforms, directly impacting your bottom line. A seemingly small difference in fee structure can translate into significant losses over time, especially for active traders. This guide aims to equip you with the knowledge to navigate the complex world of trading fees. We’ll compare fee structures for both stock trading platforms and cryptocurrency exchanges, highlighting key differences and offering practical insights to help you optimize your trading strategy. Whether you’re a seasoned investor or just starting out, understanding and comparing fees is essential for maximizing your returns in this ever-evolving financial landscape.

Overview of Stock Trading Platforms

Stock trading platforms are online services that allow individuals to buy and sell shares in publicly traded companies. They provide a convenient and accessible way to participate in the stock market, offering a user-friendly interface, research tools, and various account types. Some of the most popular stock trading platforms include:

- Fidelity Investments: Known for its low fees, robust research tools, and educational resources, making it suitable for both beginners and experienced investors.

- Charles Schwab: Offers a user-friendly platform with commission-free stock and ETF trades, along with extensive research and educational resources.

- Interactive Brokers: A powerful platform for active traders with advanced charting tools, margin trading, and access to global markets. However, it has a steeper learning curve and higher fees compared to other platforms.

- Robinhood: A popular app-based platform that offers commission-free stock and ETF trades, making it a good choice for beginners. However, it lacks advanced features and research tools.

- E*TRADE: A well-established platform with a user-friendly interface and robust research tools. It offers commission-free stock and ETF trades, but charges fees for other types of investments.

Key Features

- Trading Tools: Platforms offer various tools for research and analysis, such as charting, stock screeners, and news feeds.

- Investment Options: Access to stocks, ETFs, mutual funds, and sometimes options trading.

- Account Types: Different account types cater to various investor needs, such as individual, joint, and retirement accounts.

- Mobile Apps: Most platforms offer mobile apps for convenient trading on the go.

Benefits

- Convenience: Easy online access to the stock market.

- Research Resources: Tools to analyse investments and make informed decisions.

- Fractional Shares: Ability to purchase portions of expensive stocks.

- Educational Resources: Learn about investing and how to manage your portfolio.

Drawbacks

- Fees: Platforms charge various fees, including commissions, transaction fees, and inactivity fees.

- Limited Investment Options: Some platforms may offer only a limited selection of investment products.

- Overwhelming Research Tools: Beginners may find the abundance of information intimidating.

- Cybersecurity Risks: Platforms are vulnerable to cyberattacks, so it’s crucial to choose a reputable provider.

Fee Structure

Stock trading platforms typically charge a combination of fees, including:

- Commissions: Per-trade fees charged for buying and selling stocks. Some platforms offer commission-free trades for specific stocks or ETFs.

- Transaction Fees: Additional fees per trade, regardless of the commission.

- Account Fees: Monthly or annual fees for maintaining an account.

- Inactivity Fees: Fees charged for accounts with no activity for a certain period.

It’s crucial to understand the fee structure of each platform before opening an account. Choosing the most cost-effective platform depends on your individual trading habits and investment goals.

Overview of Cryptocurrency Exchanges

The world of cryptocurrency exchanges offers a diverse landscape catering to various user needs and trading styles. Understanding the different types and their unique features is crucial for selecting the exchange that best suits your investment goals.

Types of Cryptocurrency Exchanges

- Centralized Exchanges (CEXs):

These are the most popular type of exchange, offering a user-friendly interface and diverse trading options. They act as intermediaries, holding your funds and facilitating trades between users. Popular CEXs include Coinbase, Binance, and Kraken.

- Decentralized Exchanges (DEXs):

These peer-to-peer platforms operate without a central authority, allowing users to trade directly with each other. They emphasize security and transparency but may offer limited trading options and liquidity compared to CEXs. Popular DEXs include Uniswap and PancakeSwap.

- Hybrid Exchanges:

These platforms combine elements of both CEXs and DEXs, offering a user-friendly interface with decentralized features like self-custody of funds. They are still relatively new but have the potential to bridge the gap between centralized and decentralized services.

Unique Features and Advantages

- Wide range of cryptocurrencies: CEXs typically offer a vast selection of cryptocurrencies compared to DEXs. This allows users to diversify their portfolio and access emerging tokens.

- Margin trading: Some CEXs offer margin trading, enabling users to borrow funds to amplify their potential profits (and losses).

- Derivatives trading: Certain CEXs allow users to trade derivative instruments like futures and options, providing advanced trading strategies and risk management tools.

- Staking and lending: Several exchanges offer opportunities to earn passive income through staking or lending your crypto assets.

Potential Drawbacks

- Centralization: CEXs hold user funds and data, raising concerns about security and censorship.

- Trading fees: Trading fees on CEXs can be higher compared to DEXs, impacting profitability, especially for small traders.

- Limited control: Users on CEXs relinquish control over their private keys, potentially increasing security risks.

Fee Structure

Cryptocurrency exchanges typically charge various fees, including:

- Trading fees: These are fees incurred for executing trades, typically a percentage of the trade value. Some exchanges offer tiered fee structures based on trading volume or holding their native exchange token.

- Withdrawal fees: These are fees charged for withdrawing cryptocurrency from the exchange to an external wallet.

- Deposit fees: Some exchanges may charge fees for depositing fiat currency or cryptocurrency.

- Network fees: These are fees paid to the blockchain network for processing transactions and are independent of the exchange’s fees.

Understanding the different fee structures and their impact on your trading activity is essential for choosing the most cost-effective exchange.

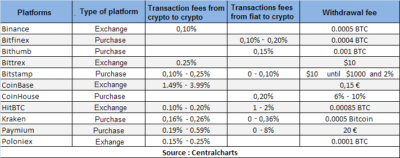

Comparative Analysis of Fees

Fees are an unavoidable aspect of trading, whether it’s stocks or cryptocurrencies. Understanding the fee structures of different platforms is crucial for making informed decisions about where to invest your money. This section will compare and contrast the fees associated with stock trading platforms and cryptocurrency exchanges, highlighting relevant factors to consider and the pros and cons of each structure.

Fee Breakdown

Stock trading platforms typically charge a commission per trade, with the rate varying depending on the platform and the volume of trades. For example, Robinhood offers commission-free trades for stocks and ETFs, while TD Ameritrade charges a $6.95 commission per trade.

Cryptocurrency exchanges, on the other hand, often charge a percentage fee based on the trade value. Binance, for instance, charges a 0.1% fee for makers and takers, while Coinbase Pro charges a tiered fee structure based on trading volume, ranging from 0.50% to 0.04%.

Specific Examples

Let’s consider a real-life example to illustrate the fee differences. Imagine you want to buy $1000 of Bitcoin. On Robinhood, you would pay no commission for the trade, while on Coinbase Pro, you would pay a fee of $0.50 (0.50% of $1000). However, if you were to trade the same amount of Bitcoin on Binance, your fee would be only $0.10. This highlights how the fee structure can vary significantly depending on the platform you choose.

Consideration of Factors

Several factors can impact the fees you’ll incur, including:

- Asset types: Different assets may have different fee structures. For example, trading penny stocks on a stock trading platform might incur higher fees than trading large-cap stocks. Similarly, trading less popular cryptocurrencies on an exchange may involve higher fees than trading Bitcoin or Ethereum.

- Trade volume: Platforms often offer tiered fee structures based on your trading volume. The more you trade, the lower your fees may be. This incentivizes high-volume traders and can be beneficial if you plan to trade frequently.

- Platform-specific features: Some platforms offer additional features, such as margin trading or staking, which may come with additional fees. It’s essential to factor these fees into your overall cost of using the platform.

Pros and Cons

Each fee structure has its own advantages and disadvantages:

Stock Trading Platforms:

Pros:

- Simple and transparent fee structure: Commissions per trade are easy to understand and compare across different platforms.

- Often commission-free for common assets: Many platforms offer commission-free trades for stocks and ETFs, making them attractive for low-cost trading.

Cons:

- Higher fees for less common assets: Trading penny stocks or other less liquid assets can incur significantly higher commissions.

- Limited features compared to crypto exchanges: Stock trading platforms typically offer fewer features than crypto exchanges, such as margin trading and staking.

Cryptocurrency Exchanges

Pros:

- Wide variety of assets and trading options: Crypto exchanges often offer a broader range of cryptocurrencies and trading pairs than stock trading platforms.

- Lower fees for high-volume traders: Tiered fee structures can significantly reduce fees for frequent traders.

- Additional features: Many exchanges offer features like margin trading, staking, and lending, which can generate additional income for users.

Cons:

- More complex fee structure: Percentage-based fees and tiered structures can be more complex to understand and compare.

- Higher fees for smaller trades: Smaller trades can incur relatively higher fees due to the percentage-based structure.

- Security concerns: Crypto exchanges have been the target of hacking and security breaches in the past.

Best Practices and Tips for Optimizing Fees

Stock Trading Platforms

- Consider commission-free platforms: Several platforms offer zero-commission trades for stocks and ETFs. Research and compare options to find the best fit for your needs.

- Utilize fractional shares: Many platforms allow fractional share purchases, enabling you to invest in expensive stocks with smaller amounts, minimizing the impact of per-trade fees.

- Opt for passive investing: Index funds offer exposure to entire market segments and typically have lower fees than actively managed funds.

- Increase trading volume: Some platforms offer volume discounts, so increasing your trading activity can potentially reduce your fees.

Cryptocurrency Exchanges

- Choose exchanges with maker-taker fee structures: These exchanges reward makers (those who add liquidity to the market) with lower fees than takers (those who remove liquidity).

- Hold native tokens: Many exchanges offer fee discounts for holding their native tokens.

- Participate in loyalty programs: Some exchanges offer tiered loyalty programs with lower fees for higher trading volumes.

- Utilize limit orders: Limit orders allow you to specify your desired price for a trade, potentially reducing the impact of taker fees.

Risk Management

Understanding and managing fees is crucial for any investment strategy. High fees can significantly impact your returns, especially for long-term investments. Before investing, research and compare fee structures of different platforms. Choose platforms with transparent and competitive fees aligned with your trading frequency and volume.

Conclusion

Choosing the right platform depends on your individual needs and trading style. If you’re a beginner, a stock trading platform with a simple fee structure and commission-free trades might be a good option. However, if you’re a more experienced trader looking for a wider range of assets and advanced features, a cryptocurrency exchange could be a better choice. Ultimately, it’s important to compare the fees and features of different platforms before making a decision.