Discover the top 10 dividend stocks to buy and hold for long-term wealth accumulation in 2023, offering consistent income and potential capital appreciation.

In the ever-changing world of finance, stability and consistent returns are highly sought after. As we enter 2023, the focus on financial security and strategic investments becomes paramount. Among these strategies, dividend stocks stand out as reliable options, offering both a share of company profits and a steady income unaffected by market fluctuations.

Think about having an investment portfolio that not only grows in value but also provides regular dividends, blending growth and income seamlessly. This exploration of “2023’s 10 Best Dividend Stocks To Buy and Hold” aims to empower investors by highlighting the most promising opportunities for the upcoming year. Throughout this journey, we’ll uncover the importance of dividend stocks, analyse current market conditions, and present a thoughtfully curated list of the top 10 dividend stocks set to excel in 2023. Join us as we navigate the world of dividends, not just for financial gains but also for sustained prosperity.

Why Choose Dividend Stocks?

Investing in dividend stocks has gained traction among investors, new and seasoned alike. In the dynamic financial world of 2023, understanding the reasons driving this trend is crucial for a solid investment portfolio.

Steady Income Stream:

Dividend stocks stand out for their consistent income provision. Unlike stocks relying solely on capital growth, these stocks offer regular cash payments. This predictable income is especially valuable for stability and financial security, making them appealing, particularly for retirees or those seeking stable returns.

Stability Amid Market Volatility:

In the financial landscape, market fluctuations are common. However, dividend stocks often showcase more stability compared to non-dividend-paying stocks. The regular dividends act as a cushion during market downturns, providing investors a shield against market swings. This stability is reassuring, especially for risk-averse investors aiming for safer investment avenues.

Long-Term Growth Potential:

Beyond immediate income, dividend stocks hold promising long-term growth prospects. Companies consistently paying dividends typically exhibit financial stability and health. Dividend payouts also signal confidence in future earnings. As these firms thrive, their stock prices often follow suit, offering investors both regular income and potential capital appreciation.

Selecting the Right Dividend Stocks:

While the advantages of dividend stocks are clear, choosing wisely is crucial. Factors like a company’s dividend history, payout ratio, and financial health require careful evaluation. Building a well-researched, diversified portfolio of dividend stocks ensures sustained income and long-term growth.

A Blend of Income, Stability, and Growth

Dividend stocks offer more than regular income and stability; they hold potential for long-term growth. Strategic investments in these stocks, carefully chosen and diversified, lay a reliable foundation for financial success amidst the complexities of 2023’s financial landscape.

Market Overview

The 2023 stock market has seen ups and downs, with moments of high volatility and relative calm. As of October 2023, the S&P 500 index has risen about 9.2% year-to-date. Yet, recent months have brought volatility due to concerns about inflation, interest rates, and the Ukraine conflict impacting investor sentiment.

2023 Stock Market Volatility

The stock market in 2023 has experienced notable fluctuations, marked by significant swings in major indices like the S&P 500 and Dow Jones Industrial Average. Several factors contribute to this volatility:

I. Ukraine Conflict: Ongoing conflict in Ukraine has injected uncertainty and anxiety into the markets. Investors are concerned about the potential global impact of the war on the economy.

II. Inflation Surge: Inflation has surged in 2023, hitting its highest level in decades. This spike raises apprehensions about potential interest rate hikes by the Federal Reserve, which could impede economic growth.

III. Economic Ambiguity: The world faces substantial economic uncertainty as investors grapple with the war in Ukraine, escalating inflation, and the looming possibility of a recession.

Amidst these challenges, positive indicators exist for the stock market. Strong corporate earnings, a robust labor market, and signals from the Federal Reserve indicating a willingness to ease interest rate hikes in the event of economic weakening provide some optimism.

Significant Trends and Factors Shaping 2023

1. Ukraine War Impact: The conflict in Ukraine is not only a major humanitarian crisis but also a significant geopolitical event. Its repercussions extend to the global economy, driving up energy prices and disrupting supply chains.

2. Inflationary Pressures: Inflation, at its highest in decades, exerts pressure on businesses and consumers. The Federal Reserve responds by raising interest rates to curb inflation, potentially slowing economic growth.

3. Recession Risk: The year 2023 carries a growing risk of recession. Factors such as the Ukraine conflict, rising inflation, and Federal Reserve interest rate hikes all pose potential economic headwinds.

4. Technological Influence: Technology continues to wield substantial influence over the economy, reflected in the stock market’s performance. Technology stocks, consistent top performers, are likely to maintain this trend.

5. ESG’s Ascendance: Environmental, social, and governance (ESG) considerations are gaining prominence among investors. Companies with robust ESG practices are perceived as more sustainable and less risky, attracting increased investment.

These represent key trends and factors impacting the 2023 stock market. Investors should carefully weigh these elements in their decision-making processes.

Top 10 Dividend Stocks

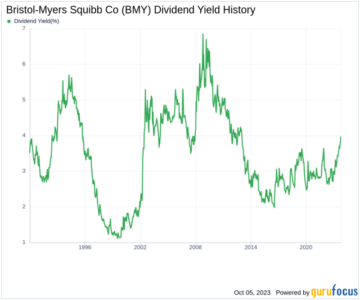

1. Bristol-Myers Squibb Co. (BMY)

• Stock symbol: BMY

• Dividend yield: 2.9%

Bristol-Myers Squibb is a global company focusing on biopharmaceuticals, creating innovative medicines for severe diseases. With a robust history of innovation, it continuously develops promising new drugs. The company’s strong management and financial stability add to its reputation.

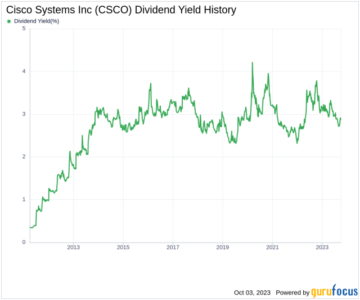

2. Cisco Systems Inc. (CSCO)

• Stock symbol: CSCO

• Dividend yield: 3.0%

Cisco stands as a global leader in networking and tech solutions, catering to businesses, governments, and individuals worldwide. Renowned for innovation, it’s well-positioned to thrive in the expanding digital economy.

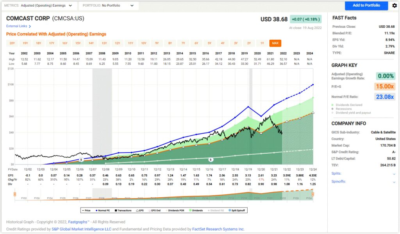

3. Comcast (CMCSA)

• Stock symbol: CMCSA

• Dividend yield: 2.6%

Comcast operates as a global media and tech enterprise. Its cable networks provide high-speed internet, video, and voice services to numerous homes and businesses. Additionally, owning NBCUniversal solidifies its position in media and entertainment.

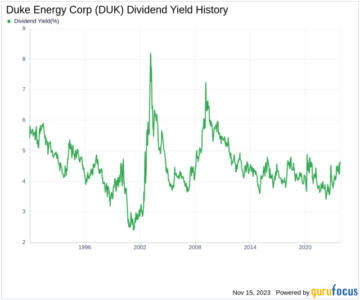

4. Duke Energy (DUK)

• Stock symbol: DUK

• Dividend yield: 3.4%

Duke Energy operates as an electric utility company in the U.S., boasting consistent dividend growth. Positioned to benefit from the transition to cleaner energy sources, it maintains a strong foothold in the industry.

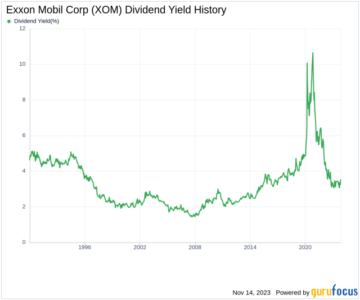

5. Exxon Mobil Corporation (XOM)

- Stock symbol: XOM

- Dividend yield: 3.7%

Exxon Mobil is a major player in oil and gas globally, excelling in production and having a strong refining and marketing business

6. Intel Corporation (INTC)

• Stock symbol: INTC

• Dividend yield: 2.2%

Intel leads in designing, manufacturing, and selling semiconductor technology worldwide. As the largest microprocessor maker, it spearheads innovations in artificial intelligence and emerging tech.

7. Johnson & Johnson (JNJ)

• Stock symbol: JNJ

• Dividend yield: 2.4%

Johnson & Johnson is a diverse healthcare company specializing in pharmaceuticals, medical devices, and consumer products. Its diversified portfolio and innovative practices define its success.

8. Microsoft Corporation (MSFT)

• Stock symbol: MSFT

• Dividend yield: 1.1%

Microsoft, a tech giant, offers software, hardware, and consumer electronics. It dominates the PC market and leads in cloud computing and emerging tech.

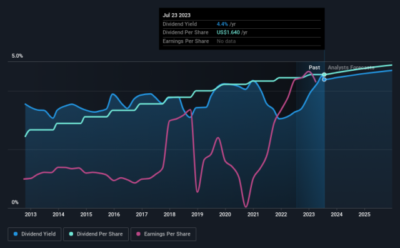

9. Pfizer Inc. (PFE)

• Stock symbol: PFE

• Dividend yield: 3.8%

Pfizer focuses on research-based pharmaceuticals and vaccines, being among the largest in the industry. Its innovation and pipeline of new drugs highlight its strength.

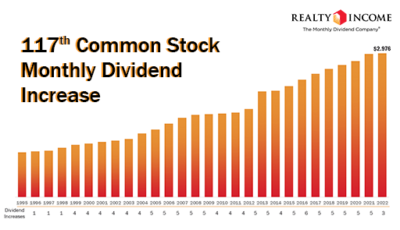

10. Realty Income Corporation (O)

• Stock symbol: O

• Dividend yield: 4.6%

Realty Income is a real estate investment trust leasing single-tenant commercial properties. Its diverse tenant portfolio and solid dividend growth mark its standing in the economy.

These are established companies with a consistent dividend payment history, strong finances, and positive growth outlooks. They could be favorable investments for those seeking income and long-term growth potential.

This list showcases notable dividend stocks for investors. Research and align your stock choices with your investment goals and risk tolerance.

Criteria for Selection

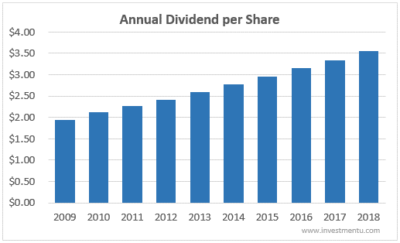

• Dividend Yield: Dividend yield is a ratio showing the yearly dividend relative to a stock’s current market price. I focused on stocks with a dividend yield of at least 3%. For every $100 invested, this means receiving at least $3 in dividends annually.

• Payout Ratio: The payout ratio represents the percentage of a company’s earnings paid out to shareholders as dividends. I sought stocks with a payout ratio below 70%. This suggests the company retains a significant portion of earnings for future growth.

• Company Stability: I prioritized companies with a strong history of dividend payments and a solid financial standing. This indicates their likelihood to sustain dividends even during economic slowdowns.

• Growth Potential: I searched for companies with consistent earnings growth and positive future prospects. This implies potential dividend increases over time.

Risk Factors and Considerations

Investing in dividend stocks offers potential for income and growth, but they come with risks that investors should weigh carefully:

I. Dividend Stability: Companies facing financial challenges might reduce or suspend dividends, impacting investor income and stock value.

II. Market Fluctuations: Even dividend stocks aren’t immune to market dips. When the market declines, these stocks can lose value despite continued dividend payments.

III. Interest Rates: Changes in interest rates affect dividend stocks more than non-dividend ones. Rising rates might make other investments more appealing, causing dividend stock prices to drop.

IV. Sector Concentration: Dividend stocks are often found in specific sectors like utilities or real estate, making them sensitive to economic changes or shifts in consumer behavior.

Mitigation Strategies

To reduce risks associated with dividend stocks, consider these strategies:

1. Diversification: Spread investments across sectors and industries to lower exposure to sector-specific risks. Also, diversify within the dividend portfolio by choosing companies with varied payout ratios and growth potential.

2. Due Diligence: Research companies thoroughly. Analyze financial health, dividend history, and growth potential to assess their ability to maintain dividends.

3. Long-Term Focus: Approach dividend investing with a long-term perspective. Focus on the company’s fundamentals and dividend sustainability, not short-term market changes.

4. Portfolio Rebalancing: Regularly rebalance your portfolio to maintain the desired mix of assets. Ensure your dividend stocks align with your risk tolerance and investment objectives.

The Bottom Line

The article highlights the significance of investing in dividend stocks for building long-term wealth. Dividend stocks signify shares of companies that regularly distribute a portion of their profits to shareholders, offering both consistent income and potential growth. It offers insight into 10 recommended dividend stocks for 2023, chosen based on factors like dividend yield, payout ratio, and growth potential. Encouraging readers to start investing in dividend stocks, it also suggests using affiliated products for research and identification of suitable stocks. The article also emphasizes the importance of considering a company’s dividend history, financial strength, and future prospects when making investment decisions. Overall, it serves as a valuable guide for individuals seeking to delve into dividend stock investments.